La Caisse publishes its 2017 Annual Report

Caisse de dépôt et placement du Québec today released its annual report for the year ended December 31, 2017.

In addition to a detailed analysis of the financial results announced on February 21, the report provides a complete review of la Caisse’s activities. Below are the highlights:

FIVE-YEAR PERFORMANCE

- Annualized return of 10.2% and $122.3-billion increase in net assets resulting from net investment results of $109.7 billion and net deposits of $12.6 billion.

- Each of the three asset classes contributed significantly to la Caisse’s overall five-year return, which outperformed its benchmark portfolio. This difference represents $12.2 billion in added value.

- The returns of the eight main clients ranged from 11.5% to 8.7%.

2017 PERFORMANCE

- Overall return of 9.3%, slightly higher than the benchmark portfolio.

- Net assets increased by $27.8 billion, resulting from net investment results of $24.6 billion and net deposits of $3.2 billion.

- The returns of the eight main clients ranged from 10.9% to 8.0%.

LA CAISSE'S IMPACT IN QUÉBEC

- New investments and commitments of $17.5 billion over five years.

- In 2017 alone, $6.7 billion in new investments and commitments brought the total assets in Québec to $63.4 billion, marking an exceptional year.

- Over five years, investments in Québec’s private sector rose 50%, totalling $42.5 billion.

- La Caisse’s strategy for Québec is based on three pillars, with several tangible achievements related to each one:

- Growth and globalization

- Investment and support for about a dozen Québec companies in their acquisitions and global expansion, including SNC-Lavalin, Cogeco Communications, Groupe Solmax and Eddyfi Technologies.

- Impactful projects

- Several milestones achieved for the Réseau express métropolitain (REM), including confirmation of the financial stakes of the Québec and Canadian governments;

- Development by Ivanhoé Cambridge of large real estate investment projects in Québec City and Montréal, including several as part of its plan for downtown Montréal: inauguration of the Maison Manuvie; reopening of the Fairmont The Queen Elizabeth hotel following a more than $140 million renovation; launching of a $200-million project at Place Ville Marie;

- Innovation and the next generation

- Investments in innovative companies in promising sectors of the new economy such as Lightspeed, eStruxture, Pivotal Payments and TrackTik;

- Commitments in two funds that seek to work with Québec companies in the technology and artificial intelligence sectors;

- Creation of a $75-million fund with Desjardins Group to foster the growth and development of new financial technology companies.

- Growth and globalization

- Partnerships with over 750 companies, including 650 PMEs, through direct and indirect investments.

- Sustained support for Québec’s economic drivers to foster the emergence and growth of strong Québec companies, and to implement projects and initiatives that make sustainable contributions to Québec’s economic vitality.

GLOBALIZATION

- Continued globalization of la Caisse’s activities, a pillar of its strategy, by:

- A 231% increase in its international assets since 2013;

- Asset diversification on a global scale, with a 58% exposure to international markets at the end of 2017, totalling $192 billion;

- A $6.5-billion increase in exposure to growth markets, including a first direct investment in Colombia in the electricity sector, a stake in Kotak Mahindra Bank in India and a partnership in residential construction in India between Ivanhoé Cambridge and Piramal Enterprises;

- Completion of key transactions alongside leading companies and partners by leveraging the expertise of our teams on the ground in the United States (in GECAS with GE Capital Aviation Services, with Greystar in Monogram Residential Trust, with KKR in USI Holdings), Europe (Fives, Sebia, Suez Technologies & Solutions), Asia and Latin America.

LESS-LIQUID ASSETS AND CREDIT

- Many transactions were completed as part of the strategy to increase our investments in less-liquid assets and credit:

- In Private Equity, more than $9.4 billion of transactions, of which $7.6 billion were at the international level. These included large investments in the U.S. financial and financial technology sectors and the European engineering and medical diagnostics industries;

- In Real Estate, investments of $8.0 billion, including the launch of investment platforms in the logistics sectors in India and China, the privatization of a residential investment trust in the United States, the purchase of a prestigious New York office building and acquisition of a U.S. industrial real estate specialist;

- In Infrastructure, a large investment in Énergir as well as in companies that are active in Québec’s renewable energy sector;

- In Fixed Income, asset diversification through an increase in higher-performing credit activities.

RISK MANAGEMENT

- In 2017, the level of market risk in the overall portfolio was essentially unchanged from 2016.

- The Risk group continued to support investment operations through its constructive influence over the teams and through active participation in the investment committees.

COMPENSATION

These past years, and especially in 2017, la Caisse accelerated its globalization strategy through offices in the major financial centres and growth markets around the world. La Caisse’s head office in Québec City and main business office in Montréal are now supported by a strong network extending to New York, Washington, London, Paris, New Delhi, Mexico, Shanghai, Singapore and Sydney.

In these markets, la Caisse competes with other Canadian and global institutional investors. To distinguish itself and seek the maximum return possible for Quebecers, la Caisse must recruit the best talent in these markets. That requires a competitive compensation program that is adapted to local conditions.

“La Caisse has adopted an ambitious strategy to deliver the results expected by its clients. In today’s world, it’s no longer enough for an investor to rely on its comparative advantages in its local markets. It also takes the agility to seize the best opportunities in international growth markets, both to invest in quality assets and to partner with the best. We are globalizing la Caisse by seeking the return opportunities necessary to ensure Quebecers’ retirement,” stated Robert Tessier, Chairman of the Board of la Caisse.

falsefalse

“The Board is confident that, at the end of this phase, which will conclude soon, the organization will have the resources necessary to develop new partnerships, seize new opportunities and target new geographic regions,” concluded Mr. Tessier.

falsefalse

The underlying principles of the compensation program for all la Caisse employees, both in Québec and abroad, are the same:

Main objective (p. 92 of the Annual Report)

- Pay for performance by taking into account returns generated for depositors and a sustained performance over several years.

- Offer competitive compensation to attract, motivate and retain employees whose expertise enables la Caisse to reach its strategic objectives.

- Align the interests of employees and depositors over the long term.

Implementation and application

- Rigorous benchmarking of reference markets by a recognized, independent firm, Willis Towers Watson (p. 94).

- At the request of the Board of Directors, a validation of the fair application of the compensation program was performed by Hugessen Consulting, an independent firm recognized for its expertise in the compensation of pension fund personnel (p. 94).

- Review of each employee’s performance based on a rigorous process to determine incentive compensation (p. 95).

Mandatory co-investment thresholds

- To better align employees’ interests with the sustained long-term success of la Caisse, a significant portion of the total incentive compensation of managers and senior professionals is deferred over a three-year period.

The minimum thresholds must be put into a co-investment account for employees with direct influence on la Caisse’s organizational and financial performance:- At least 55% of the total incentive compensation of senior executives – or more than half of their incentive compensation – thereby strengthening the alignment of executives’ interests with those of depositors and making this measure even more stringent than current industry practices;

- 35% of the total incentive compensation of senior vice-presidents, vice-presidents and intermediate and senior investment employees;

- 25% for other managers and high-level professionals.

- The deferred amounts to be paid in 2020 in respect of 2017 are at risk because they will increase or decrease according to la Caisse’s average absolute overall return during this period, in compliance Canada Revenue Agency rules.

- This year, under the incentive compensation program, employees (including senior executives) deferred, until 2020, an amount of $35.5 million. Employees of la Caisse’s international subsidiaries deferred $6.7 million to the co-investment portfolio.

- Incentive compensation that was co-invested under the program was paid in 2017, pursuant to program conditions and applicable tax rules. Amounts paid in 2017, which had been co-invested in 2014 by the five most highly compensated executives who report to the President and Chief Executive Officer are provided in Table 41 on page 100 of the 2017 Annual Report.

Incentive compensation

- Since 2016, performance has been measured over a five-year period, to further strengthen sustained performance over the long term (before 2016, the period was four years).

- Including incentive compensation, total compensation of la Caisse’s employees in 2017 stood at the median of reference markets for an annualized return of 10.2% over a five-year period, corresponding to $12.2 billion of value-added versus the benchmark portfolio (p. 93).

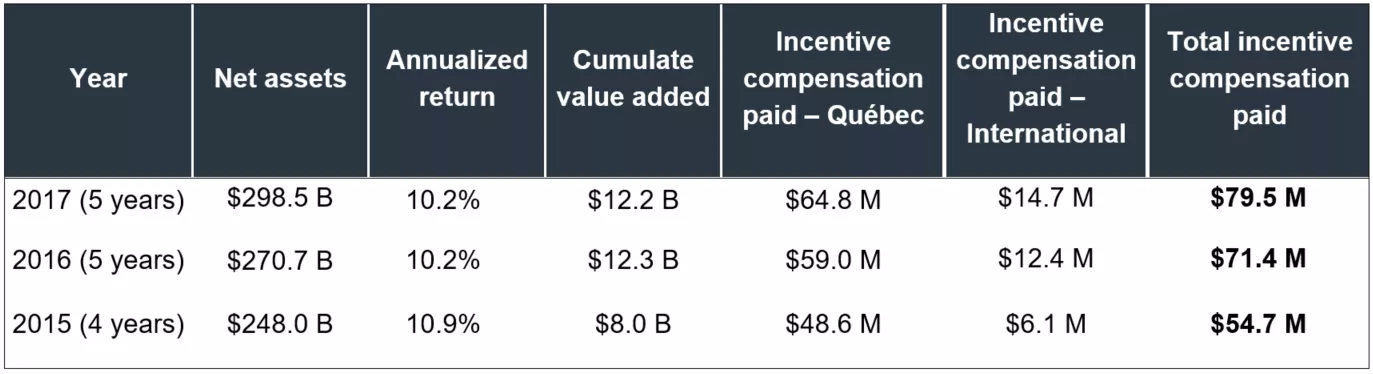

- Pursuant to la Caisse’s strategy to deliver sustained performance over the long term, the following table compares incentive compensation paid in these years to the cumulative value added.

- The increase in incentive compensation from 2016 to 2017 is the result of sustained returns and an increase in the number of employees to allow la Caisse to execute its strategy in Québec and internationally, particularly in Private Equity, Infrastructure, and for creating the new Credit portfolio, also contributed to this increase.

Compensation for 2017 reflects sound management and tight control of costs, as shown by the following facts:

- Despite sustained performance of 10.2% over the last five years continuing in 2017, the average incentive compensation is down 2.7%.

- Each $1,000 in value added generated over five years by la Caisse now corresponds to a $0.05 in incentive compensation for employees, compared with $0.21 in 2013.

- For each $1,000 in value added generated over five years by la Caisse, the overall compensation costs were stable at $0.01 for each year from 2013 to 2017.

- Québec depositors also received more for their money, with each dollar spent on base salaries, which generated $719,000 in net investment results in 2013, now generating $900,000 in net investment results.

Compensation of the President and Chief Executive Officer

Base salary and direct compensation

- At his request, Mr. Sabia has received no salary increase since he was appointed in 2009. His base salary remained unchanged in 2017 as it will be in 2018.

Incentive compensation and co-investment

- In accordance with policies that emphasize achievement of la Caisse’s business objectives and its performance, this year the Board of Directors is of the opinion that “Mr. Sabia has, once again this year, delivered remarkable performance and has surpassed the objectives set” (p. 96).

- Despite this performance, Mr. Sabia requested for his 2017 incentive compensation to be the same as in 2016. Mr. Sabia was paid $1,160,000 of the incentive compensation and elected to defer an amount of $1,740,000 into the co-investment account. The value of this amount will be increased or decreased according to la Caisse’s average absolute return over the three-year period ending in 2020.

- Pursuant to Canada Revenue Agency rules, he was required to withdraw $1.5 million that was disclosed and coinvested in 2014, in addition to the return earned over the period (p. 100).

Pension plan and severance pay

- When Mr. Sabia was appointed, he waived membership in any pension plan for the duration of his mandate. He also waived any severance pay.

Comparisons to reference markets

- Details regarding the compensation of the President and Chief Executive Officer and the five most highly compensated executives are provided on pages 97 to 103 of the annual report.

- Page 103 provides a comparison to reference markets, which shows that total compensation paid in 2017 to the President and Chief Executive Officer and the five most highly compensated executives is on average 38% below the maximum for the reference markets.

EXPENSES

- In 2017, la Caisse’s expenses ratio was $0.22 per $100 of average net assets, a level that compares favourably to that of its industry. This represents an average annual increase of $0.01 per $100 of average assets over the last five years.

- Expenses cover operating expenses, including compensation and external management fees.

- Around 90% of la Caisse’s assets are managed internally, allowing for savings of two to six times what it would cost to have the assets managed externally.

STEWARDSHIP INVESTING

- To accompany its annual report, la Caisse will soon publish its first Stewardship Investing Report, which will set out its vision and commitments to priority topics:

- Climate change: A new strategy to address climate change, where the climate will factor into each investment decision.

- Women in business

- Governance

- International taxation

- Investment processes

- Social involvement

The electronic version of the 2017 Annual Report and the 2017 Annual Report Additional Information are available here:

ABOUT CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

Caisse de dépôt et placement du Québec (CDPQ) is a long-term institutional investor that manages funds primarily for public and parapublic pension and insurance plans. As at December 31, 2017, it held CAD 298.5 billion in net assets. As one of Canada’s leading institutional fund managers, CDPQ invests globally in major financial markets, private equity, infrastructure, real estate and private debt. For more information, visit cdpq.com/en, follow us on Twitter @LaCDPQ or consult our Facebook or LinkedIn pages.

- 30 -