Creation of the Sodémex Développement Fund

The Caisse de dépôt et placement du Québec announced the creation of Sodémex Développement, a $250-million fund. This new fund, to which the Caisse has been committed since November 2012, will make investments of $5 million to $20 million in Québec companies in the natural resources sector that are in the development stage. A flexible, hybrid financing structure that can take the form of a debenture, a convertible debenture or equity will be introduced to meet the needs of Québec companies while ensuring an acceptable level of risk.

“The current business climate in the natural resources sector can present attractive long-term investment opportunities,” said Normand Provost, Executive Vice-President, Equity at the Caisse. “This represents a critical entry point for the Caisse in projects that are in the development stage.”

The development phase represents a critical period because these companies are often acquired by bigger players in their industry due to insufficient capital to continue operations. This new fund will alleviate the shortage of available capital.

Selection criteria

The process implemented to grant financing is based on discipline and rigour. The selected projects must show promise and meet the following criteria:

- The executive team must:

- Be solid and experienced

- Have technical and operational knowledge of the sector

- Have very sound knowledge of the market

- Have a high-quality board of directors that complements the management team

- Quality of the field

- In terms of size

- In terms of content

- In terms of the types of minerals present

- Global competitiveness

- In terms of production and operating costs

- In terms of being close to adequate infrastructure

- Acceptability

- A credible and well-established social acceptability and sustainable development process

Strong leadership

This fund will be supported by a board of directors comprised of three members from the Caisse and two external members.

The Caisse recently appointed two external members with technical and operational expertise in the natural resources sector and knowledge of sustainable development and social acceptability. They are:

- Jean Desrosiers, Vice-President, Mining Operations at Xstrata Zinc Canada. Mr. Desrosiers will be retiring in June 2013 after 45 years in the industry. Over his long career, Mr. Desrosiers has headed many mining operations and development projects in Québec and internationally.

- Henri-Paul Girard, who has served 36 years in the mining sector and was, until very recently, Vice-President, Canadian operations at Agnico Mines. Mr. Girard offers strong technical knowledge. He was involved in designing and building four mines, was in charge of five shaft-sinking projects, and evaluated several mining projects in America and Finland.

The internal members at the Caisse, who also have substantial sector-based knowledge, are:

- Dany Pelletier, Mining Engineer, MBA and Director, Investments for Large Corporations and Development Capital

- Cyrille Vittecoq, Vice-President, Investments for Large Corporations and Development Capital

- Stephen Poitras, Analyst, Equity Markets and Geologist

In addition, Sodémex announced the arrival of Carl Gilbert, who will be heading Sodémex Développement. Mr. Gilbert has many years of experience in the investment sector related to natural resources. His functions required him to evaluate and carry out many investment projects in the mining sector in addition to portfolio management. He will be joining the Québec City offices as Investment Director, alongside Denis Landry, President of Gestion Sodémex.

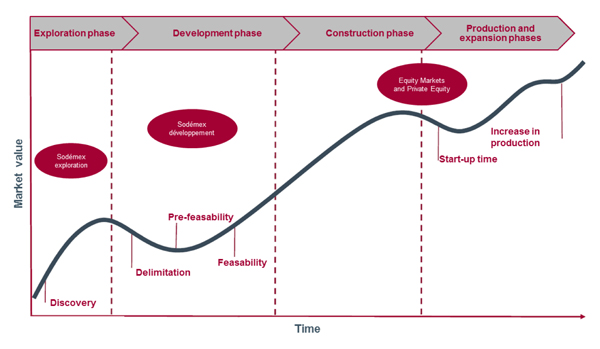

The Caisse: present in all phases

With the creation of the Sodémex Développement fund, the Caisse will now have a presence with Québec companies active in the natural resources sector in all stages of development, from exploration to mining activities.

The Caisse has been active since 1996 in the Sodémex Fund, which is for Québec mining companies in the exploration phase. This fund represents an investment of approximately $50 million. Sodémex Exploration has interests in more than 60 companies with market capitalizations under $500 million.

The Caisse is also active in the production stage, through equity markets and private equity.

ABOUT THE CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

The Caisse de dépôt et placement du Québec is a financial institution that manages funds primarily for public and private pension and insurance plans. As at December 31, 2012, it held $176.2 billion in net assets. As one of Canada’s leading institutional fund managers, the Caisse invests in major financial markets, private equity, infrastructure and real estate globally. For more information: www.cdpq.com

- 30 -