La Caisse de dépôt et placement du Québec and CRCD invest nearly $200 million in 186 Québec companies

In less than three years, close to $200 million has been invested in 186 companies across Québec in the first phase of the Capital croissance PME (CCPME) fund, according to its sponsors, Capital régional et coopératif Desjardins (CRCD) and La Caisse de dépôt et placement du Québec (CDPQ). Established in 2010, the fund offers small and medium-sized businesses financing for growth, expansion, transfers or acquisitions.

“Today, we celebrate the success of this initiative, which has supported the growth of so many small Québec businesses,” said Normand Provost, Executive Vice-President, Private Equity, at La Caisse de dépôt et placement du Québec. “Given these outstanding results, it goes without saying that we will renew our investment in the Capital croissance PME fund to further support the today and tomorrow’s champions from all regions.”

Marie-Claude Boisvert, Chief Operating Officer of Desjardins Business Capital régional et coopératif, believes CCPME has fulfilled its promises in every respect. “When we created this financial lever, we wanted to provide entrepreneurs with patient, flexible capital, available everywhere in the regions. The entrepreneurs were there and took advantage of the resources made available to them. Their projects have had a noticeable effect on local economies.”

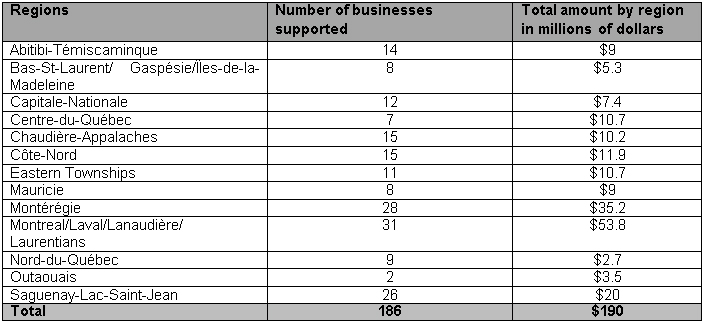

A significant impact on Québec regions

After three years of sustained activity, Capital croissance PME has supported various business projects that have proven to be a boost for all regional economies.

Tangible results, Some examples of tangible results:

A new life for Récupère Sol – Saguenay–Lac-Saint-Jean

- CCPME assisted in the purchase of Récupère Sol inc. (RSI) by its executive director, Jean-François Landry. Founded in 1992, RSI specializes in the remediation of contaminated soil. It employs 45 people at its plant in Saint-Ambroise and generates about $6 million in spinoffs annually in Saguenay–Lac-Saint-Jean.

Sherbrooke OEM becomes 100% Québec-owned – Eastern Townships

- With the help of Capital régional et coopératif Desjardins and La Caisse de dépôt et placement du Québec, Sherbrooke OEM, a company specializing in the design, manufacturing and integration of custom recycling equipment, has bought back shares held by U.S. interests, thus becoming a 100% Québec-owned company. This has ensured the maintenance and creation of quality jobs in Sherbrooke.

Supported innovation at Productions horticoles Demers – Chaudière-Appalaches

- The support of CCPME was a tremendous stimulus for innovation at Productions horticoles Demers, a Lévis company specializing in the production of greenhouse tomatoes and berries. The company built a new greenhouse in Saint-Nicéphore, near Drummondville, which is kept warm by heat recovered from a cogeneration plant fuelled by biogas.

A passport to new horizons for LVL Studio – Montréal

- LVL Studio is a Montréal company specializing in the design and development of services and applications for the world of television and media content. CCPME enabled the company to refine its products and services, propelling it to become one of the most innovative of its industry, which has allowed it to win many large contracts.

Successful acquisition by Groupe MBI – Central Québec

- Capital croissance PME helped Michel Blanchette, President of Groupe MBI, of Bécancour, acquire a share in the ownership of Reftch international in order to diversify its range of products and services. Groupe MBI specializes in the field of masonry and refractory brick and now has 11 satellite companies. This family-owned company has four main partners: Michel Blanchette, his son Luc, his brother Pierre and his cousin Marc. Other members of the family are active in the development of this solid international company, which employs more than 300 people here and abroad.

Already $7.6 million committed to nine companies through CCPME II fund

CRCD and the CDPQ are also announcing their agreement to new the Capital croissance PME ll fund. The two sponsors have recently renewed their partnership and the fund’s operations were launched in January 2014. With market capitalization of $230 million ($115 million per sponsor), CCPME ll aims to meet the financial needs of Québec companies, primarily in the form of subordinated loans of less than $5 million. In this way, CCPME ll will continue the mission of supporting economic development and the growth of small and medium-sized businesses. As at February 28, nine companies already obtained financing from this new phase, totalling $7.6 million.

About La Caisse de dépôt et placement du Québec

La Caisse de dépôt et placement du Québec is a financial institution that manages funds primarily for public and private pension and insurance plans. As at December 31, 2013, it held $200.1 billion in net assets. As one of Canada’s leading institutional fund managers, La Caisse invests in major financial markets, private equity, infrastructure and real estate, globally. For more information: www.cdpq.com.

About Capital régional et coopératif Desjardins

With over 100,000 shareholders and $1,471 million in net assets, Capital régional et coopératif Desjardins (CRCD) is a public company managed by Desjardins Business Capital régional et coopératif. CRCD contributes to Québec economic development through several levers developed with its manager, with CRCD as the driving force. These levers form CRCD’s entrepreneurial ecosystem designed to value and nurture the best of Québec entrepreneurship. Directly or indirectly through its ecosystem, CRCD supports the growth of over 360 businesses, cooperatives and funds in various industries spanning all Québec regions, helping to create and retain 47,000 jobs. (www.capitalregional.com)

- 30 -