The Caisse publishes its 2012 Annual Report

The Caisse de dépôt et placement du Québec today made public its 2012 Annual Report after it was tabled in the National Assembly by Québec’s Minister of Finance and the Economy.

In addition to a detailed analysis of the financial results announced on February 27, the 2012 Annual Report provides a complete review of the Caisse’s operations.

The highlights are as follows:

2012 PERFORMANCE

- A 9.6% overall return and a $17.2-billion increase in net assets consisting of net investment results of $14.9 billion and net deposits of $2.3 billion;

- Fifteen of the 16 specialized portfolios posted positive results; and

- The returns of the eight main depositors ranged from 8.2% to 10.5%.

CONTRIBUTION TO QUÉBEC’S ECONOMIC DEVELOPMENT

- A three-pronged strategy:

- Seek out and act on the best business and investment opportunities;

- Serve as a bridge between Québec companies and global markets; and

- Strengthen the new generation of entrepreneurial and financial leadership.

- Strong growth of the Caisse’s new Québec investments and commitments, which reached $2.9 billion in 2012 and total $8.3 billion since 2009;

- A $5.9-billion increase in the Caisse’s Québec assets in 2012 for a total of $47.1 billion as at December 31 (see page 62 of the Annual Report);

- A $5.1-billion increase in assets in the private sector for a total of $27.6 billion at the end of 2012;

- A $1.4-billion increase in the Canadian Equity portfolio’s investments in Québec companies for a total of $4.7 billion at the end of 2012.

- $55 million of investments in more than 60 small and mid-sized businesses in all regions of Québec, in partnership with Desjardins Group; and

- An additional $150 million to strengthen Québec’s publicly traded small caps.

RISK MANAGEMENT

- Active, rigorous management of credit, concentration, counterparty and liquidity risks (see pages 45 and 46 of the Annual Report);

- A slight increase in absolute risk, which went from 30.0% at the end of 2011 to 30.6% at the end of 2012 and in active risk, which went from 3.4% to 4.4% (see page 45 of the Annual Report);

- Despite this slight increase, the market risk of the overall portfolio remains well below the levels observed in 2009 and 2010.

- Liquidity totalling $41 billion as at December 31, 2012, enabling the Caisse to respect its potential commitments, even in the event of a major market correction; and

- Overall leverage of 18%, or less than half the level of leverage at the end of 2008.

COMPENSATION

Recap of the characteristics of the compensation program introduced in 2010

Main objectives (see page 101 of the Annual Report)

- Pay for performance taking into account the returns generated for depositors and a performance sustained over several years;

- Offer competitive compensation to attract, motivate and retain employees with the know-how the Caisse needs to achieve its strategic objectives; and

- Ensure senior management’s interests are aligned with those of the depositors.

Implementation and application

- Rigorous benchmarking of reference markets was performed by Towers Watson, a recognized firm;

- At the request of the Board of Directors, Hugessen Consulting, an independent firm recognized in the pension fund industry, confirmed the equitable application of the compensation program;

- The performance of each employee is subject to a stringent evaluation process to determine entitlement to incentive compensation (see page 102 of the Annual Report).

Co-investment and better alignment of interests

- To foster a better alignment of employees’ interests with the Caisse’s long-term success, a significant portion of the total incentive compensation of some groups of employees is deferred over a three-year period:

- At least 40% of the total incentive compensation of members of senior management;

- 25% of the total incentive compensation of managers and high-level professionals;

- The deferred amounts paid in 2015 will be increased or decreased as a function of the Caisse’s average overall absolute return during that period.

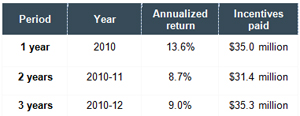

2012 incentive compensation

- The objective of the incentive compensation program is to reward a performance sustained over a period of four years. The Caisse has been applying this program for three years, and performance is therefore evaluated over that period. Taking into account the incentive compensation paid, the overall compensation of the Caisse’s employees for 2012 is below the median of the reference markets for a 9.0% annualized return over three years (2010, 2011 and 2012) corresponding to $5.2 billion more than the benchmark portfolio and equivalent to a superior first-quartile performance (see page 104 of the Annual Report);

- The total incentive compensation paid in 2013 in respect of 2012 was $35.3 million (including senior management);

- In 2012, under the incentive compensation program, employees (including senior management) deferred $14.0 million until 2015. In addition to the mandatory deferred portion, the Caisse offers high-level managers and professionals the option of deferring and co-investing an additional portion of their incentive compensation in the co-investment portfolio. In 2012, they voluntarily increased the amounts deferred and co-invested by more than 20%.

- The incentive compensation paid in 2013 in respect of 2012 to the five most highly compensated executives who report directly to the President and Chief Executive Officer totalled $2.41 million, versus $2.56 million in 2011.

Compensation of the President and Chief Executive Officer

- On joining the Caisse, Michael Sabia waived any form of incentive compensation for 2009 and 2010. He also waived membership in any pension plan for the duration of his mandate as well as any severance pay at the end of his employment;

- In accordance with his request, Mr. Sabia has received no increase in salary since he joined the organization in 2009. His base salary was unchanged in 2012 and will remain the same in 2013;

- As for Mr. Sabia’s incentive compensation for 2012, in accordance with policies that emphasize achievement of the Caisse’s business objectives and the organization’s performance, the Board of Directors deemed the performance of the President and Chief Executive Officer to be excellent and granted him incentive compensation based on achievement of these objectives (see page 106 of the Annual Report);

- Of this incentive compensation, an amount of $500,000 was paid to Mr. Sabia and he elected to defer $700,000 in the co-investment portfolio. The value of the co-invested amount will increase or decrease as a function of the Caisse’s returns between now and 2015;

- For 2012, the total compensation of the President and Chief Executive Officer, including base salary and incentive compensation paid and deferred for a superior performance was 62% less than the potential direct maximum compensation of the presidents and chief executive officers of eight major Canadian pension funds.

EXPENSES

- Expenses include operating expenses, including compensation and external management fees;

- The ratio of expenses to average net assets was 17.9 basis points in 2012, a level well below the median of the Caisse’s peers;

- Operating expenses down $19 million, or 6.1% over the past five years;

- Since 2010, $25 million of recurring annual savings as a result of the introduction of a new operational business model, of which $20 million is associated with information technology.

RESPONSIBLE INVESTMENT

- The Caisse’s Policy on Responsible Investment has three components:

- Inclusion of environmental, social and governance (ESG) criteria in the analysis of investments and the related risks (see page 77 of the Annual Report);

- Shareholder engagement (see page 78 of the Annual Report); and

- Exclusion of some securities from the portfolio (see page 82 of the Annual Report).

- Various types of action were taken under this policy in 2012, including:

- Voting on 45,059 proposals in the context of 4,807 shareholder meetings (see pages 78 to 82 of the Annual Report); ando Involvement in various initiatives, including the Carbon Disclosure Project, the Water Disclosure Project and the Extractive Industries Transparency Initiative.

ABOUT THE CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

The Caisse de dépôt et placement du Québec is a financial institution that manages funds primarily for public and private pension and insurance plans. As at December 31, 2012, it held $176.2 billion in net assets. As one of Canada’s leading institutional fund managers, the Caisse invests in major financial markets, private equity, infrastructure and real estate globally. For more information: www.cdpq.com.

- 30 -