CDPQ posts a 6.3% five-year return

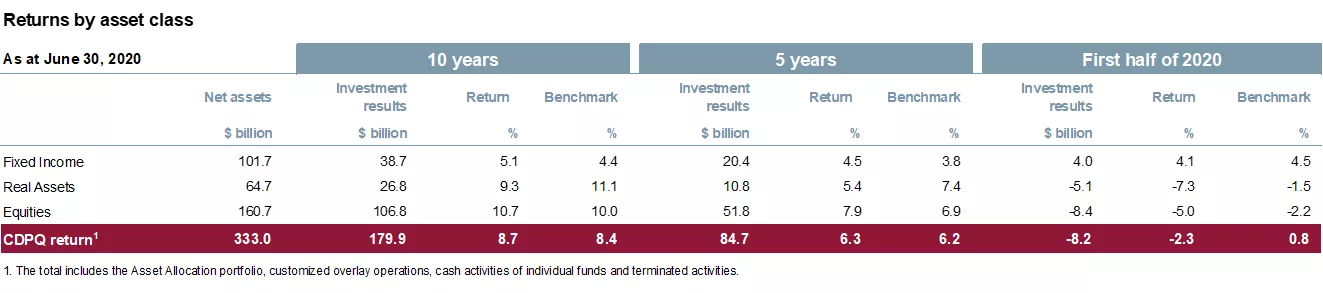

Caisse de dépôt et placement du Québec (CDPQ) today presented an update of its performance as at June 30, 2020. Over five years, CDPQ posted an annualized return of 6.3%, representing investment results of $84.7 billion. The annualized return over ten years is 8.7%. Over six months, a period marked by the COVID‑19 pandemic, the average return for depositors was -2.3%. CDPQ’s net assets were $333.0 billion.

“In the first half of 2020, the global economy was hit by a crisis that was unprecedented both in its speed and reach. Exceptional central bank monetary policies coupled with historic government assistance programs have prevented the recession from becoming a depression, but there is a growing dichotomy between the real economy and financial markets,” said Charles Emond, President and Chief Executive Officer of CDPQ. “With the pandemic having sharply accelerated trends, especially in technology and retail, our significant exposure to shopping centres and our underweight position in certain Big Tech stocks in equity markets impacted the portfolio’s performance in the first half of the year.”

falsefalsePleine largeurfalse

“Despite the very difficult global context of recent months, CDPQ is in a solid financial position to weather the conditions of its business environment and has produced returns that exceed the needs of its clients over the long term. As the economic recovery shows signs of fragility, we must be even more vigilant and remain extremely rigorous. In the first six months of 2020, we took several concrete actions to position our portfolios and protect our depositors’ capital,” added Mr. Emond.

falsefalsePleine largeurfalse

“In March, at the height of the crisis, we created a $4-billion envelope, 45% of which is being or has already been allocated, to support Québec companies that are temporarily impacted by the situation. This initiative aligns perfectly with our dual mandate—generating returns for our depositors and supporting Québec companies—because we want these businesses to be strong and well positioned in the economic recovery,” concluded Mr. Emond.

falsefalsePleine largeurfalse

Concrete actions during the crisis

In light of this unique crisis, CDPQ took measures to ensure tighter coordination between asset classes and take advantage of future opportunities, including:

- An in-depth review of all portfolio assets to identify sectors of the future and potential risks, in order to better define the post-COVID‑19 strategy.

- Cautious and disciplined management of liquidity, including new debt issuances to refinance existing debt at favourable rates.

- New, co-ordinated steering of the strategy, portfolio construction and risk management activities.

- An exhaustive assessment of refinancing needs, especially in less-liquid assets—the Infrastructure and International Private Equity teams actively supported portfolio companies in obtaining nearly $5 billion in financing from capital markets to weather the pandemic.

- Acceleration of our Real Estate portfolio’s repositioning, primarily in the shopping centre sector, which will allow expanding toward promising segments such as industrials and logistics over time.

- The adoption of a new, cross-functional approach to technology built on three main elements: anticipating and seizing investment opportunities created by technology and disruptive models; protecting invested capital by further incorporating technology into risk management; and pursuing the transformation of business practices to remain an agile and cutting-edge organization.

- Rigorous capital deployment in Fixed Income, notably in public markets at the height of the crisis, with an emphasis on investment-grade bonds, and acquisitions of several billion dollars on stock markets in March and April, following a sharp market correction.

Return highlights

Over ten years, CDPQ’s annualized return was 8.7%, outperforming its benchmark portfolio, which stood at 8.4%. Over five years, CDPQ’s annualized return was 6.3%, slightly above the 6.2% of its benchmark portfolio, with investment results of $84.7 billion. Over the five-year period, the annualized returns of CDPQ’s eight largest depositors varied between 5.8% and 6.7%.

As at June 30, 2020, depositors’ net assets were $333.0 billion. Over six months, CDPQ recorded a -2.3% return, attributable notably to the large historical exposition to shopping centres in the Real Estate portfolio and the Equity Market portfolio’s underweighting in certain Big Tech stocks.

In Fixed Income, CDPQ generated a 4.5% annualized five-year return, above the 3.8% return of its benchmark, representing $3.3 billion of added value. This performance was driven by its investments in corporate credit and real estate debt. Over six months, during which rates were falling, the class generated a 4.1% return.

For Real Assets, a class that is comprised of the Real Estate and Infrastructure portfolios, the annualized five-year return was 5.4%, compared to 7.4% for its benchmark index. Over six months, the return for the class was -7.3%, compared to its benchmark, which was -1.5%. In both cases, the difference mainly stems from the shopping centre sector and from office buildings in the United States. The Real Estate portfolio under-performed, and valuations of Ivanhoé Cambridge’s portfolio assets reflect the difficulties with shopping centres, which are heightened by the COVID‑19 crisis. In contrast, the Infrastructure portfolio delivered the expected performance in a context where it could have been harder hit due to the uncertainty of the economic environment.

Over five years, the Real Estate portfolio generated an annualized return of 3.5%. For the first six months of the year, it posted a -11.7% return. The challenges in retail and shopping centres, which COVID‑19 greatly intensified, accelerated the implementation of Ivanhoé Cambridge’s action plan, which was announced at the beginning of the year and will be deployed over the coming years. The subsidiary therefore intends to actively pursue the orderly transformation of its shopping centre portfolio, which will require tailor-made solutions for each asset, as well as continue its repositioning in market segments such as industrials, or in mixed-use projects, which integrate the commercial, residential, office and logistics sectors to better meet the needs of local communities.

For the Infrastructure portfolio, CDPQ produced an annualized return of 8.2% over five years, and of -1.0% for the first half of 2020. Despite its exposure to the transportation sector, where some assets, including airports, ceased operations at the height of the crisis, the portfolio showed resilience. The quality of the assets in sectors such as renewable energy and telecommunications, as well as the continuous support provided to portfolio companies since the crisis started, has allowed the portfolio to significantly limit the impacts of COVID‑19.

Lastly, in Equities, the five-year annualized return is 7.9%, outperforming the 6.9% return of its benchmark index and generating added value of $4.8 billion. This result was driven by good performances in the Global Quality mandate and the Private Equity portfolio. The latter, which alone produced added value of around $4 billion, benefits from its direct investments that are well diversified by sector and geography, including investments in numerous Québec companies.

In the first half of 2020, the -5.0% return for this asset class results mainly from the limited exposure to technology stocks in the Equity Markets portfolio during a pandemic wherein they reached record highs. Indeed, the returns of the securities in the global stock market index (MSCI ACWI) are greatly dispersed in the first half of 2020. On one hand, the stocks of five technology giants (GAFAM) recorded a performance of 31.4%; and on the other hand, some 3,000 other stocks in the index posted a combined performance of -4.8%. In Private Equity, particularly on the international front, the portfolio has been resilient due to assets in essential sectors such as insurance and health care, as well as technology. It is also worth noting that, despite their excellent performance in recent years, CDPQ’s biggest positions in certain Québec large caps took a harder hit, temporarily, in the first six months of 2020, negatively affecting the return for the class during the period.

Period highlights

During the first half of the year, CDPQ executed quality transactions across its various asset classes. In Private Equity, it concluded a major agreement to invest in Alstom, as part of the company’s proposed acquisition of Bombardier Transport (BT), thereby strengthening its global leadership in sustainable mobility. This agreement, which recently obtained the green light from the European Commission, would convert CDPQ’s existing investment in BT into shares of Alstom, on top of an additional investment of €700 million. Expected to close in 2021, the transaction would result in CDPQ holding, through its total investment, which will amount up to $4 billion, approximately 18% of the company, with commitments that will have a structuring effect for Québec.

In addition, in Québec, beyond the $4 billion envelope announced at the beginning of the crisis, CDPQ had already supported the international acquisition strategies of various portfolio companies during the first part of the year. Such activities include the acquisition by Knowlton Development Corporation (KDC/ONE) of Zobele Group, a global leader in innovating and manufacturing home cleaning and air care products, further consolidating KDC/ONE’s position among the most innovative manufacturers in the world. CDPQ also supported Eddyfi in executing its growth plan by acquiring NDT Global, a company based in Ireland, as well as Norway’s Halfwave. It also repatriated the Canadian activities of Canam Group to Québec as part of an $840-million transaction with Placements CMI (Dutil family) and Fonds de solidarité FTQ. Lastly, it invested to support the digital initiatives of certain companies, including LCI Education and Monarch Gold Corporation.

In Infrastructure, CDPQ reinvested in Azure Power, a renewable energy leader in India, bringing its total stake in the company to 50.9%. It also acquired Plenary Americas, a leader in investing, developing and operating public infrastructure in North America that is advantageously positioned to address infrastructure needs, particularly in the United States.

In Real Estate, Ivanhoé Cambridge began an extensive restructuring of its positioning in the shopping centre sector while continuing to grow investments in promising sectors, such as logistics. During the first six months of the year, it concluded transactions totalling $4.5 billion, including $2 billion in acquisitions primarily in industrials and logistics, $1.6 billion in strategic sales and $0.9 billion in capital investments for development or redevelopment purposes. In Asia, alongside LOGOS, it launched its fourth logistics development vehicle, with a US$800-million capacity, building on the success of the three previous platforms. In France, the real estate subsidiary acquired Hub&Flow, a portfolio of 17 logistics assets in the main hubs of Paris and Lyon in addition to becoming the majority shareholder of a housing development platform for students and young professionals in the Paris region, and acquired Joya, a 50,000 m² office campus project that will provide adaptable spaces with flexible amenities.

Lastly, in Fixed Income, CDPQ pursued its strategy in credit, particularly in the insurance sector. In Europe, CDPQ and its partners participated in a commitment of £1.875 billion, the world’s largest unitranche financing, for The Ardonagh Group, the U.K.’s largest insurance brokerage.

Financial Reporting

CDPQ’s annualized operating expenses were 23 cents per $100 of average net assets, which compares favourably to its industry and is the same as on June 30 last year.

CDPQ also has strong liquidity, which allows it to meet future commitments and face market events. The credit rating agencies reaffirmed CDPQ’s investment-grade ratings with a stable outlook, namely AAA (DBRS), AAA (S&P), Aaa (Moody’s) and AAA (Fitch Ratings).

ABOUT CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

Caisse de dépôt et placement du Québec (CDPQ) is a long-term institutional investor that manages funds primarily for public and parapublic pension and insurance plans. As at June 30, 2020, it held CAD 333.0 billion in net assets. As one of Canada’s leading institutional fund managers, CDPQ invests globally in financial markets, private equity, infrastructure, real estate and private debt. For more information, visit cdpq.com, follow us on Twitter @LaCDPQ or consult our Facebook or LinkedIn pages.

- 30 -