CDPQ publishes its 2019 Annual Report

Caisse de dépôt et placement du Québec (CDPQ) today released its Annual Report for the year ended December 31, 2019, a little later than usual due to the exceptional situation related to COVID‑19. In addition to the detailed analysis of its financial results released on February 20, the report provides a complete overview of its activities. Here are some highlights:

PERFORMANCE OVER TEN YEARS

- Annualized return of 9.2%.

- Net assets increased from $131.6 billion in 2009 to 340.1 billion in 2019, with $191.0 billion in net investment results and $17.5 billion in net deposits.

- The proportion of assets invested in international markets rose from 36% in 2009 to 66% in 2019.

PERFORMANCE OVER FIVE YEARS

- Annualized return of 8.1% and net assets grew $114.2 billion, with net investment results of $106.0 billion and net deposits of $8.2 billion.

- As at December 31, 2019, CDPQ’s five-year return outperforms its benchmark portfolio by 0.9%. This difference represents $11.0 billion in value added.

- Returns for the eight main depositors ranged from 7.2% to 8.9%.

PERFORMANCE IN 2019

- Global return in 2019 of 10.4%, below the benchmark portfolio by 1.6%.

- Net assets grew by $30.6 billion on net investment results of $31.1 billion, offset by net depositor withdrawals of $0.5 billion.

- Returns for the eight principal depositors ranged from 9.5% to 10.8%.

CDPQ’S IMPACT IN QUÉBEC

- Total assets in private Québec companies have now reached $47.6 billion, an increase of over 155% in 10 years.

- Partnered with over 750 companies, including over 650 SMEs.

- New investments and commitments of $21.9 billion over five years.

- Several solid achievements in each pillar of CDPQ’s strategy in Québec, including:

- Impactful projects: Continued construction on several branches of the Réseau express métropolitain (REM), including 2 kilometres of rails on the South Shore, and the launch of construction on ten stations.

- Growth and globalization: Investment and support for the growth and globalization of Québec companies, including Alt Hotels, Sollio Cooperative Group (formerly La Coop fédérée), Golf Avenue, Nuvei and Top Aces.

- Innovation and the next generation: Creation of a $250-million fund for companies specializing in artificial intelligence and launch of a $50-million envelope for seed funds for innovative companies.

GLOBALIZATION

- Continued globalizing CDPQ’s activities, a pillar of its strategy, which has resulted in a 2% increase in exposure to global markets, reaching 66% at the end of 2019, including:

- Increased investments in the United States, including one in partnership with Hilco Global, a leader in financial services, to support its growth strategy, and another with Ontario Teachers’ Pension Plan (OTPP) and Constellation, to launch a global insurance platform.

- Key transactions in growth markets with partners, including LOGOS in India, Prologis in Brazil and Australis Partners, IFC and Organización DeLima in Colombia.

LESS-LIQUID ASSETS AND CREDIT

- Private Equity: Investments of $10.5 billion in various growing companies in Québec and around the world, major transactions in various sectors, including security services in the United States, health care in Australia and the pharmaceutical industry in Mexico.

- Infrastructure: Almost $5 billion in investments with acquisitions of significant stakes in various companies, including alongside a global energy leader established in Brazil and a U.S. leader in wireless communication towers, as well as in various ports around the world.

- Real Estate: A market undergoing major changes that requires an active transition to lower the weight of more traditional assets and prioritize opportunities in tomorrow’s sectors. In 2019, more than $11 billion in acquisitions, capital investments and sales, significant increase in assets in promising industrial real estate sectors, especially in Asia Pacific, Brazil and India, and in logistics in the United Kingdom.

- Credit: Loans to various companies, including Lightsource BP to create a global solar asset platform and to Maestria Condominiums to finance the construction of this residential project in Montréal.

RISK MANAGEMENT

- In 2019, market risk remained stable compared to 2018 and was slightly above that of the benchmark portfolio.

- During the year, CDPQ enhanced its post-investment monitoring process.

STEWARDSHIP INVESTING

- To accompany its Annual Report, CDPQ published its Stewardship Investing Report, which sets out its vision and commitment to priority topics:

- Climate change

- Diversity

- Governance

- Investing in the community

- In terms of the fight against climate change, CDPQ has added $16.8 billion in low-carbon assets since 2017, including $6.9 billion in 2019.

- Since 2017, the portfolio’s carbon intensity was reduced by 21% against an objective of a 25% reduction by 2025.

- Proactive leadership in co-founding the Net-Zero Alliance, an initiative that calls on major investors to commit to achieving carbon-neutral portfolios by 2050.

- Since 2018, in collaboration with 14 international peers, CDPQ has taken concrete and direct action on climate change, diversity and sustainable infrastructure as part of the Investor Leadership Network.

- The electronic version of the Stewardship Investing Report.

COMPENSATION

The principles underlying the compensation program for CDPQ employees in Québec and around the world remain unchanged: pay for performance that is aligned with returns delivered to depositors, offer competitive compensation and link the interests of management and depositors (see page 91 of the Annual Report).

However, as the world is experiencing the unprecedented COVID‑19 pandemic, CDPQ decided, given current economic conditions, to freeze the salaries of all leaders in the organization for 2020 and postpone the payment of 2019 variable compensation to the third quarter. In addition, the members of the Executive Committee have decided to postpone and co-invest the maximum possible of their variable compensation for a period of three years as of January 1, 2020, until 2022.

Implementation and application

- Rigorous benchmarking against reference markets by a recognized independent firm—Willis Towers Watson—and studies on positions based outside of Canada by McLagan.

- At the request of the Board of Directors, validation of the application of the compensation program was conducted by Hugessen Consulting, an independent consulting firm recognized for its expertise in the compensation of pension fund personnel.

- CDPQ’s Compensation Policy complies with the Principles for Sound Compensation Practices issued by the Financial Stability Board and endorsed by the G20 nations: effective compensation governance; alignment of compensation with long-term, measured risk-taking; and regular review of compensation practices.

- Review the performance of each employee using a rigorous evaluation process to determine the variable compensation, based on individual performance, portfolio or team returns and CDPQ’s performance, measured over five years.

- A component is linked to the carbon footprint intensity reduction target to support CDPQ’s strategy to address climate change.

Mandatory co-investment thresholds

- To foster better alignment of employees’ interests with CDPQ’s ongoing long-term success, a significant portion of total variable compensation of management and senior professionals is deferred for a period of three years, in compliance with the rules of the Canada Revenue Agency, which requires the amounts to be paid at the end of that period.

It is mandatory to place minimum amounts in a co-investment account for employees who have direct influence on CDPQ’s organizational and financial performance:- At least 55% of the total variable compensation of members of senior management, thereby strengthening the alignment of management and depositor interests and making this measure even more stringent than common industry practice–with the exception of 2019, for which the threshold was raised to include the maximum possible variable compensation due to COVID‑19.

- 35% of total variable compensation for vice-presidents and intermediate and senior investment employees.

- 25% for other managers and high-level professionals.

- The deferred amounts to be paid in 2022 that relate to 2019 are put at risk, as they will rise and fall in tandem with CDPQ’s absolute overall return during this period.

- This year, as part of the variable compensation program, employees (including senior management) have deferred until 2022 a total of $44.2 million. Employees of CDPQ’s international subsidiaries deferred a total of $13.3 million into the co-investment portfolio.

- Amounts co-invested as part of the variable compensation program were paid in 2019, in compliance with program conditions and applicable tax rules. Amounts paid in 2019 that had been co-invested and reported in 2016 by the five most highly compensated executives reporting to the President and CEO are presented in Table 38 on page 101 of the 2019 Annual Report.

Variable compensation

- Since 2016, performance has been measured over a five-year period, which further strengthens its long-term sustainability.

- Including variable compensation, total compensation for CDPQ employees in 2019 was slightly below the median of the reference markets for superior performance over five years, where the 8.1% annualized return corresponds to $11 billion in valued added compared to the benchmark portfolio (page 94).

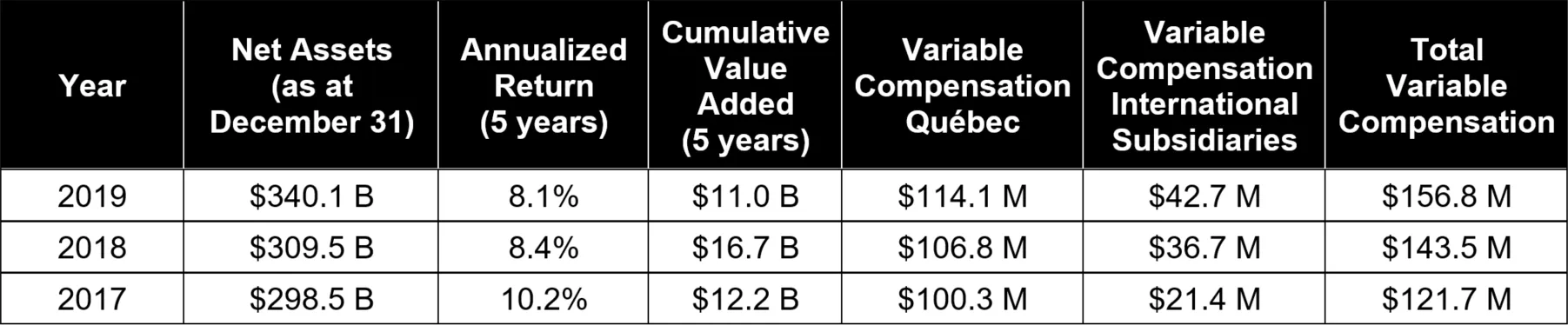

- In keeping with CDPQ’s strategy to deliver sustained long-term performance, the following table contrasts the 2019 variable compensation awarded to CDPQ employees relative to absolute returns generated and value added, which includes a deferred portion that will rise and fall with future returns.

- The increase from 2018 to 2019 in variable compensation awarded mainly stems from an increase in the number of investment employees.

- CDPQ’s exposure to global markets now represents 66% of the portfolio and generates advantageous returns for its depositors.

- CDPQ also generated conclusive results over the last five years in Québec, with over $21 billion in new investments and commitments over the period.

Compensation for 2019 reflects sound management and rigour in control over costs, as the following facts show:

- CDPQ’s operating expenses and external management fees, which remained around the same level in 2019 as in 2018, was 23 cents per $100 of average assets—up barely 1 cent—a ratio that compares favourably to that of its industry.

- Around 90% of CDPQ’s assets are managed internally, which is five times less costly than managing assets externally.

- Senior executive compensation is below the maximum of 42% on average (see the tables on pages 94 and 100).

“To perform in a competitive environment, you need to have the best talent, both here and around the world. This will be even more important in the next decade, as the global economy suddenly lost steam and CDPQ’s portfolio is tested. Our organization has the teams to take on this challenge under the leadership of Charles Emond as President and Chief Executive Officer,” said Robert Tessier, Chairman of CDPQ’s Board of Directors.

falsefalsePleine largeurfalse

Compensation of the President and Chief Executive Officer

Base salary and direct compensation

- Pursuant to policies on achieving CDPQ’s business objectives and organizational performance, the Board considers that “the President and Chief Executive Officer had surpassed the objectives that he had been given at the beginning of the year and that his performance during 2019 greatly exceeded their expectations of him.”

- Mr. Sabia’s base salary remained unchanged at $500,000 in 2019 and his variable compensation awarded for performance for the year was $3,857,000, which will be paid in the third quarter of 2020. Including the value of the pension and other forms of compensation, his total awarded compensation for the year was $4,425,300.

Co-investment

- In light of his stepping down, and pursuant to the variable compensation program, his co-investment accounts for 2016 to 2018 were fully disbursed at the time of his departure.

Pension plan and severance

- When Mr. Sabia was appointed he waived membership in any pension plan for the duration of his mandate, except for mandatory plan membership under Retraite Québec rules for management personnel.

- He also waived any severance.

Comparison to reference markets

- Additional details on the compensation of the President and CEO and the five most highly compensated executives are provided on pages 96 to 104 of the Annual Report.

The electronic version of the 2019 Annual Report and 2019 Additional Information are available at:

ABOUT LA CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

Caisse de dépôt et placement du Québec (CDPQ) is a long-term institutional investor that manages funds primarily for public and parapublic pension and insurance plans. As at December 31, 2019, it held CAD 340.1 billion in net assets. As one of the largest pension fund in Canada, CDPQ invests globally in financial markets, private equity, infrastructure, real estate and private debt. For more information, visit cdpq.com, follow us on Twitter @LaCDPQ or consult our Facebook or LinkedIn pages.

- 30 -