CDPQ posts 5.6% return over six months, 8.5% over five years

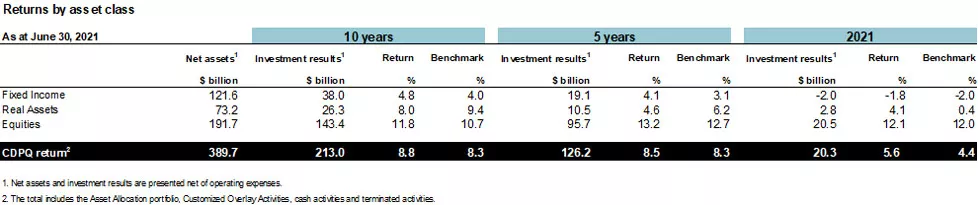

Caisse de dépôt et placement du Québec (CDPQ) today presented an update of its performance as at June 30, 2021. Over six months, CDPQ posted a return of 5.6%, outperforming its benchmark index’s 4.4% return. Over five years, CDPQ generated an annualized return of 8.5%, compared to 8.3% for its benchmark index, and produced $126 billion in investment results. Over ten years, CDPQ’s annualized return was 8.8%, also above its benchmark portfolio, which stood at 8.3%. Net assets reached $390 billion.

“In the first half of 2021, our teams continued to position the portfolios to navigate a new environment, especially in Real Estate and Equity Markets, where ongoing initiatives are already producing tangible results,” said Charles Emond, President and Chief Executive Officer of CDPQ. “Overall, the portfolios each played their part in the performance delivered. During the period, we also increased our exposure to promising sectors, such as logistics and technology.”

“The global economic recovery still varies widely and reflects both the uneven progress on vaccinating populations and controlling the pandemic in different regions. We’re also facing conditions marked by a lot of uncertainty, especially with concerns around inflation and geopolitical tensions. At the same time, abundant capital is still stimulating fierce competition for assets, while valuations are particularly high,” added Mr. Emond.

“Our responsibility to our depositors and the more than six million Quebecers they represent is to produce returns that meet their needs over the long term. We’ve adopted clear strategies to deliver this performance: diversifying our investment activities, creating value in our portfolio companies by leveraging the accelerated digitalization and the energy transition, in addition to protecting our assets from challenges related to cybersecurity and geopolitical risks. Also, in the current environment, agility and adaptability will be key,” concluded Mr. Emond.

Return highlights

Fixed Income: Six-month performance marked by a swift and substantial rise in rates

In Fixed Income, where sharply rising interest rates have depressed bond markets, CDPQ posted a six-month return of -1.8% against -2.0% for its benchmark index, largely due to a short-duration strategy. Over five years, this asset class recorded a 4.1% annualized return, which was higher than the 3.1% posted by its benchmark index, representing value added of nearly $5 billion. This result is explained by the superior yield from securities in the portfolio, notably in corporate credit and real estate debt activities.

Real Assets: Investments in the new economy central to real estate results and sustained infrastructure performance

For Real Assets, which includes the Real Estate and Infrastructure portfolios, the six-month return was 4.1%, compared to 0.4% for the benchmark index, a performance that was driven mainly by new economy assets, such as logistics, renewable energy and telecommunications. The Real Estate portfolio generated a 4.1% return for the six-month period, producing $1.9 billion in value added compared to the -0.9% of its benchmark index, which signals good progress in repositioning the portfolio. For Infrastructure, the portfolio earned a 3.9% return for the period, compared to 1.9% for its benchmark index. This result notably stems from the good performance of assets in the wind and solar energy sector.

Over five years, Real Assets posted an annualized return of 4.6%, compared to 6.2% for the benchmark index. The difference is largely attributable to the historically greater allocation to shopping centres and traditional office buildings at Ivanhoé Cambridge, which were hard hit by the pandemic.

Equities: More than $2 billion in value added over six months in Equity Markets and profitable sectors in Private Equity

Over six months, the Equities asset class recorded a 12.1% return, while its benchmark index posted 12.0%. The Equity Markets portfolio obtained an 11.4% return, compared to 9.3% for its benchmark index. The portfolio is now better positioned to perform optimally in different market environments and managed more dynamically, thereby benefiting from investor appetite for risk that propelled stock market indexes. Over the same period, the Private Equity portfolio posted a 13.5% return on the strength of the excellent operational performance of its assets, including support by CDPQ’s teams for the growth through acquisition strategies of portfolio companies. The difference between the portfolio’s return and the 16.8% obtained by its benchmark index for the six-month period can be explained in part by the portfolio’s underweighting in the traditional energy and financial institutions sectors.

The asset class earned a five-year annualized return of 13.2%, above the 12.7% of its benchmark index. It generated $4.6 billion in value added, mainly driven by the Private Equity portfolio, which posted the best five-year performance of all the portfolios. This results in part from its strategy focused on promising sectors such as health care, insurance and technology.

Key achievements

There were numerous transactions in targeted sectors in the first six months in infrastructure, real estate and private equity, including several in Québec.

Infrastructure: Major investments in essential sectors that have shown resilience during the crisis

In Infrastructure, CDPQ’s teams pursued sustained deployment, with over $8 billion invested or committed in promising sectors, and a significant share in telecommunications and assets related to transportation of goods. Among these transactions are major acquisitions in the telecommunication tower sector in Brazil and Europe, including an investment of over EUR 1.6 billion in ATC Europe. CDPQ also acquired a 15% stake in the Indiana Toll Road, a key transportation link for moving merchandise in the United States. The first half of the year was also characterized by CDPQ’s entry into the Indonesian infrastructure market with the construction of a USD 1.2-billion logistics and industrial port in partnership with DP World and Maspion Group, and the signing of a memorandum of understanding with local and international investors to establish the country’s first infrastructure investment platform, which aims for a capacity of around USD 3.75 billion.

Real Estate: Acceleration of portfolio diversification, with investments in the logistics, technology and life sciences sectors

CDPQ’s real estate subsidiary, Ivanhoé Cambridge, accelerated the repositioning of its activities toward sectors such as logistics, technology and life sciences, as well as sustainable housing. In the first six months of the year, it completed nearly 40 transactions totalling $5.1 billion, with $1.6 billion in acquisitions, $2.4 billion in dispositions and $1.1 billion in capital investments for development or redevelopment purposes.

Of note among the acquisitions is the creation of a new investment platform in partnership with GID Industrial, with a combined portfolio representing 19 million square feet (1.77 million square metres), which will target “last kilometre” industrial assets in fast-growing markets across the United States. Ivanhoé Cambridge also partnered with Lendlease to develop a project in Massachusetts that includes an ultramodern building at 60 Guest Street dedicated to life sciences, a sector supported by long-term trends. In addition, to take advantage of opportunities in technology, Ivanhoé Cambridge became the main shareholder in the funds managed by Fifth Wall, the largest venture capital firm focused on real estate technology. Lastly, in the sustainable housing space, Ivanhoé Cambridge announced a partnership with Round Hill Capital and Mubadala to invest in high-quality residential assets in the Netherlands.

Private Equity: Key transactions in high-performing sectors

In Private Equity, CDPQ continued to invest in targeted sectors. On the international front, two acquisitions were announced by Constellation, a property and casualty (P&C) and life insurance platform with a USD 1-billion investment capacity. In addition, CDPQ led a USD 147-million financing round in Druva, a global leader in cloud data protection and management based in California. It also increased its stake in PharmEasy, the largest digital health platform in India, by participating in new fundraising of approximately USD 250 million to finance the acquisition of Medlife, its closest competitor and number two in the country.

Investments in Québec: An active role supporting the growth and international expansion of Québec companies

In Québec, CDPQ continued to increase its presence in the context of a reopening economy through over thirty investments and commitments in the first six months of the year. Key strategic investments include its involvement in the privatization of New Look Vision Group in a transaction that valued the company at $1 billion, as well as the creation of a global platform of communication agencies, including Vision 7 International, which will be headquartered in Québec City.

As part of an announced $1.14-billion transaction, CDPQ will strengthen its role as controlling shareholder of Énergir. It also reinvested $475 million in CAE, a global aerospace leader, becoming the company’s largest shareholder. In addition, CDPQ invested USD 75 million in iNovia Capital, a fund focused on growing technology companies, as well as participating in a $225-million financing round in AlayaCare to foster the digital transformation of home health care.

In Greater Montréal, the Réseau express métropolitain reached some major milestones, with: around thirty active work sites, 23 stations under construction and dynamic testing of the light metro system on the South Shore. Its $7.8-million public art program was also unveiled. For the REM de l’Est project, a committee of 15 multidisciplinary experts was set up and an information and public consultation process was started in May to optimize the project.

Lastly, Ivanhoé Cambridge announced, as part of a group including the Government of Québec, the Government of Canada and Fonds de solidarité FTQ, a total investment of $151 million to build, acquire and renovate 1,500 affordable housing units in Québec.

Financial reporting

CDPQ’s annualized operating expenses stood at 23 cents per $100 of average net assets, a level which compares favourably with that of its peers and is unchanged from the same date last year. The credit rating agencies reaffirmed CDPQ’s investment-grade ratings with a stable outlook, namely AAA (DBRS), AAA (S&P), Aaa (Moody’s) and AAA (Fitch Ratings).

Additionally, the inaugural issue of USD 1 billion in green bonds took place in the first half of the year.

ABOUT CDPQ

At Caisse de dépôt et placement du Québec (CDPQ), we invest constructively to generate sustainable returns over the long term. As a global investment group managing funds for public retirement and insurance plans, we work alongside our partners to build enterprises that drive performance and progress. We are active in the major financial markets, private equity, infrastructure, real estate and private debt. As at June 30, 2021, CDPQ’s net assets totalled CAD 390 billion. For more information, visit cdpq.com, follow us on Twitter or consult our Facebook or LinkedIn pages

- 30 -