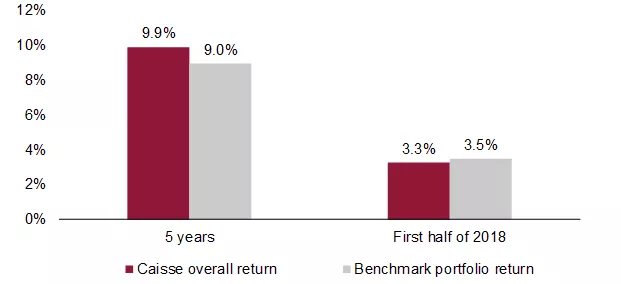

La Caisse posts a five-year annualized return of 9.9% and a six-month return of 3.3%

Today, Caisse de dépôt et placement du Québec presented an update of its performance as at June 30, 2018. Over five years, the weighted average annual return on clients’ funds was 9.9%, representing net investment results of $111.3 billion and bringing la Caisse’s net assets to $308.3 billion. Compared to its benchmark portfolio, la Caisse produced $11 billion of value added over the period. For the first six months of 2018, the average return on clients’ funds was 3.3%.

Caisse overall return and benchmark portfolio

“The market environment became more complex in the first half of the year. Tightening liquidity conditions and protectionist measures by the U.S. have increased volatility since January,” said Michael Sabia, President and Chief Executive Officer.

falsefalse

“The long-running global bull market is slowing down. As the U.S. Federal Reserve continues to normalize its monetary policy and rates gradually climb, we are seeing a change of tone in the markets. The active support the markets have become used to since the financial crisis has ended, and they now face real geopolitical challenges – primarily escalating trade tensions. We remain vigilant in these hypersensitive markets that are in transition, and we will continue to focus on resilient assets,” he added.

falsefalse

HIGHLIGHTS

In the first half of 2018, la Caisse pursued its strategy to diversify its sources of returns by investing in credit and less-liquid assets. In these categories, it concentrated on the new economy, as well as on renewable energy and green technology. Investments made will contribute to reducing the portfolio’s carbon footprint and generate attractive returns for its clients.

In Fixed Income, la Caisse, jointly with Fonds de solidarité FTQ, signed an agreement with Boralex to invest up to $300 million by way of an unsecured subordinated loan in this Québec-based renewable energy leader in Canada and France. To date, la Caisse has invested $170 million under this agreement, which follows a nearly 20% stake taken in the company in 2017.

In Private Equity, la Caisse continued to apply its direct investment strategy with several transactions in leading companies in Québec and abroad. In technology and innovation, la Caisse supported the international ambitions of several Québec companies that each stand out in their sector, including Stingray, FX Innovation, Breather and Poka. It created, jointly with Agropur Cooperative, a co-investment platform to foster innovation in the dairy industry. La Caisse also financed growth projects at La Maison Simons, BFL CANADA and Metro Supply Chain Group.

In Europe, as part of a consortium with Partners Group, la Caisse announced the acquisition of German-based Techem, a global leader in the energy sub-metering market valued at around €4.6 billion. It also took a significant capital stake in Alvest, a French company specialized in electric airport ground support equipment, in partnership with Ardian. La Caisse also concluded an agreement with the Delachaux family to acquire CVC Capital Partners’ stake in the Delachaux Group, a French engineering firm that provides high-value-added industrial solutions.

In Real Estate, Ivanhoé Cambridge continued to focus on the industrial and logistics sector, which is benefitting from the continued rise of e-commerce. This subsidiary of la Caisse made a strategic investment in Peel Logistics Property, following the establishment of a logistics venture in the United Kingdom. In addition, it acquired 38% of Pure Industrial Real Estate Trust, which manages a portfolio of North American industrial properties. In Québec, Ivanhoé Cambridge announced major investments to redevelop its flagship shopping centres: $200 million for the Eaton Centre, as part of its $1 billion plan to revitalize downtown Montréal, and $60 million for Laurier Québec, to enhance customer experience.

In Infrastructure, la Caisse was active in the renewable energy sector. It acquired a significant additional stake in Invenergy Renewables, the largest private North American company in this sector, bringing its interest to 52.4%. It also recently increased its stake in Azure Power Global, one of India’s largest solar energy producers.

In addition, CDPQ Infra, la Caisse’s infrastructure subsidiary, concluded the planning phase of the Réseau express métropolitain (REM) in spring 2018. Construction of this public transportation network began shortly after, with the first trains scheduled to run in summer 2021. La Caisse’s investment in this $6.3 billion growth-creating project for Québec is $2.95 billion.

PERFORMANCE HIGHLIGHTS

As at June 30, 2018, clients’ net assets totalled $308.3 billion, up $9.8 billion from $298.5 billion as at December 31, 2017. This growth is attributable to net investment results of $9.4 billion, in addition to net deposits of $0.4 billion.

Returns by asset class and benchmark index

Over five years, la Caisse generated an annualized return of 9.9%, outperforming its benchmark portfolio, which stood at 9.0%. This difference represents $11 billion in value added. Over the period, the annualized returns of la Caisse’s eight largest clients varied between 8.7% and 11.1%.

The Fixed Income asset class posted an annualized return of 4.1%, driven mostly by current yield and the contribution of corporate bonds. It benefitted from asset diversification and an increase in higher-performing credit activities, particularly private debt and mortgage loans. In Real Assets, the Real Estate and Infrastructure portfolios generated a combined annualized return of 10.5%, attributable to high current yields and the asset’s good operating performance. Among the asset classes, Equities recorded the highest return over five years with 13.5%, outpacing its index, which was 11.8%. Of the $8.1 billion value added by the asset class, $4.9 billion stem from the Equity Markets portfolio and $3.2 billion from the Private Equity portfolio. Their performance reflects both strong growth in global stock markets over the period and the strategies adopted. The selection of high-quality securities, exposure to the U.S. market and the weighting of Québec securities in the portfolio were major contributors to the return, as were Private Equity investment choices.

For the half year ended June 30, 2018, la Caisse generated a 3.3% return, compared with 3.5% for its benchmark portfolio. With rising yields in the bond market, the Fixed Income asset class produced a 1.1% return and net investment results of $1.0 billion, which are mainly explained by the current yield. Real Assets posted a 5.0% return and net investment results of $2.6 billion, resulting from the good performance of real estate and infrastructure assets. With modest equity market performance since January, the Equities asset class obtained a 4.0% return and net investment results of $5.6 billion, a large part of which is attributable to Private Equity. Of the mandates in the Equity Markets portfolio, Global Quality generated one of the best six-month returns and the highest return over five years. In contrast, Growth Markets slipped due to a downturn in certain countries caused by rate increases in the U.S. market and trade tensions that lured investors back to the United States. This mandate still posted high performance over five years with a good contribution from active management. Growth economies also present strong long-term potential. In general, the overall portfolio benefits from its exposure to global markets, both over six months and five years.

FINANCIAL REPORTING

The liquidity of la Caisse’s overall portfolio remains robust, allowing it to meet potential commitments and contingencies, as well as providing the necessary agility to seize market opportunities. Annualized operating expenses were 23 cents per $100 of average net assets, a level which compares favourably with that of its industry.

ABOUT CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

Caisse de dépôt et placement du Québec (CDPQ) is a long-term institutional investor that manages funds primarily for public and parapublic pension and insurance plans. As at June 30, 2018, it held CAD 308.3 billion in net assets. As one of Canada’s leading institutional fund managers, CDPQ invests globally in major financial markets, private equity, infrastructure, real estate and private debt. For more information, visit cdpq.com, follow us on Twitter @LaCDPQ or consult our Facebook or LinkedIn pages.

- 30 -